And ultimately, though, there’s so much uncertainty around these things.

– Federal Reserve Chairman Jerome Powell

Financial markets struggled during the third quarter. Resilient economic activity, elevated equity valuations and a re-evaluation of the Federal Reserve’s determination to maintain restrictive monetary policy pushed bond yields up and both stock and bond prices down. Equity indices’ solid progress year to date remains intact, but underneath the surface, only a handful of stocks are driving it all. Equal-weighted indices and indices that include medium and small companies are up marginally this year or flat, a reflection of the economic and monetary policy uncertainty that confronts investors.

Financial markets struggled during the third quarter. Resilient economic activity, elevated equity valuations and a re-evaluation of the Federal Reserve’s determination to maintain restrictive monetary policy pushed bond yields up and both stock and bond prices down. Equity indices’ solid progress year to date remains intact, but underneath the surface, only a handful of stocks are driving it all. Equal-weighted indices and indices that include medium and small companies are up marginally this year or flat, a reflection of the economic and monetary policy uncertainty that confronts investors.

In fact, our own confidence that a recession will occur is lower today than it was earlier this year. Nevertheless, our baseline expectation still includes a mild recession at some point next year, due in large part to some early warning signals about the strength of the labor market and the U.S. consumer. Moreover, although inflation is moderating, the stickiest components of inflation suggest that further moderation could be much slower than the Federal Reserve desires, and as a result, the Fed may raise rates again before year end. All of which points to rising economic vulnerability coinciding with rising downward pressure on the economy from monetary policy.

Slower economic growth and/or higher interest rates create risks for earnings estimates and equity valuations. With equity market gains concentrated in a handful of stocks, equity valuations somewhat elevated, and relatively attractive opportunities in the bond market after the third quarter’s rise in yields, we see equities as vulnerable, especially the large technology stocks that have performed exceptionally well this year (read our second quarter Review on the dynamics of that). Of course, even in this environment, there are attractive opportunities in individual equities, but selectivity and discipline will be necessary, in our opinion, over the rest of this year and into 2024.

The Global Economy

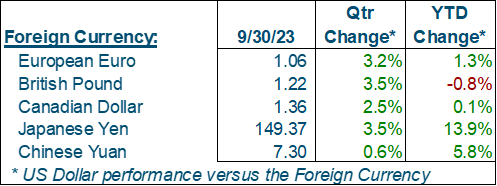

Third quarter global economic activity looked a lot like second quarter global economic activity; steady, but uninspiring. Tight labor markets continue to support consumer spending, but consumers’ preference for services over physical goods kept the global manufacturing sector in a slump. Inflation eased but remains uncomfortably above central bank targets.

Third quarter global economic activity looked a lot like second quarter global economic activity; steady, but uninspiring. Tight labor markets continue to support consumer spending, but consumers’ preference for services over physical goods kept the global manufacturing sector in a slump. Inflation eased but remains uncomfortably above central bank targets.

In Asia, China’s real estate sector continues to buckle under the weight of tepid demand from would-be buyers, unsustainable debt burdens, and unfinished projects. Developer bankruptcies accelerated during the quarter, and while the Communist government has relaxed some restrictions in the hopes that buyers will return to the market, the massive amount of debt and opaque connections between property developers and local governments will require a large-scale coordinated rescue plan if China wishes to avoid a property and debt bubble bust similar to what Japan experienced in the 1980’s, the aftermath of which can still be seen in the country’s struggle with deflation today.

In Europe, a recession could begin in the fourth quarter. Prolonged weakness in the manufacturing sector is now accompanied by contraction in the services sector, which had been the continent’s strength coming into the quarter. Although inflation moderated during the quarter, at roughly 5%, it remains well above the European Central Bank’s (ECB) target, which is why, despite the deteriorating economic outlook, the ECB raised rates twice in the quarter and may raise rates again before year end. The cumulative effects of prior rate increases, and any potential future ones, will weigh on economic activity through the remainder of the year and most of 2024.

In the U.S., the labor market’s resilience will delay a potential recession, if it occurs at all, to 2024. Although small and medium-sized businesses have significantly curtailed their hiring, and large companies are shedding employees, we suspect hiring overall is slowing simply because there aren’t many available workers to hire anymore, which keeps the unemployment rate low (3.8%) and inflation-adjusted disposable income positive (up 3.5% year over year in August). This in turn supports ongoing consumer spending for services, even if retail sales, which are mostly goods, have stagnated. Household debt remains reasonable, and despite higher interest rates for credit cards and new mortgages, monthly debt payments have only returned to pre-Covid levels. Although credit card delinquencies and charge offs rose during the quarter, they remain well below multi-decade and pre-Covid averages.

That’s not to say that everything in the U.S. economy is firing on all cylinders. Inflation remains elevated, labor productivity is poor, corporate profits remain under pressure, and the manufacturing sector continues to contract. Banks are tightening lending standards, and small businesses, which rely on bank loans to fund operations, are increasingly pessimistic about the future of the economy, citing inflation, labor quality and taxes as their most important problems.

Considering the improvements in labor market balance and inflation, weighed against notable deterioration in other areas, the Federal Reserve’s pause after raising rates in July is logical, although most of its governors still expect to raise rates one more time before the end of the year, concerned that inflation’s decline will stall without further pressure from the Fed. Which is why the Fed’s communication efforts consistently focus on a “high rates for longer” message, a perspective investors are increasingly adopting as well.

Equities

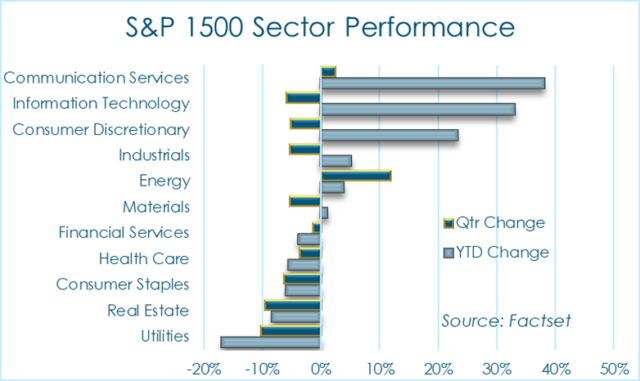

With the exception of the energy sector, U.S. equities struggled during the quarter. We attribute the weakness to several factors including, on the one hand, concerns that economic activity will slow markedly next year, and on the other hand, concerns the Federal Reserve will have to keep rates elevated through most of next year. We would also point to the disparity between the astronomical performance of a handful of large information technology, communications services, and consumer electronics companies, and the paltry performance year to date of the rest of the stock market.

With the exception of the energy sector, U.S. equities struggled during the quarter. We attribute the weakness to several factors including, on the one hand, concerns that economic activity will slow markedly next year, and on the other hand, concerns the Federal Reserve will have to keep rates elevated through most of next year. We would also point to the disparity between the astronomical performance of a handful of large information technology, communications services, and consumer electronics companies, and the paltry performance year to date of the rest of the stock market.

To wit, the headline S&P 500 index, which favors the largest companies in the index such as Apple, Amazon, Meta (Facebook and Instagram), Alphabet (Google) and Microsoft, is up nearly 12% for the year while the equal-weighted S&P 500 Index is flat. The S&P 400 index of medium-sized companies and the S&P 600 Index of small companies are also both roughly flat for the year. Large technology companies appear to be the sole focus for investors this year.

Which makes some sense; with an uncertain economic outlook, investors have chosen to take shelter in large, highly profitable and capital-efficient technology companies with scale advantages and structural growth tailwinds. However, the concentration of capital within a handful of companies represents a significant risk for investors, one that only marginally unwound during the third quarter.

Constructively, after falling all year, revenue, earnings, and cash flow estimates for the rest of this year and next have stabilized. Although pricing power may be dissipating, softening wage pressures and normalized supply chains equate to less pressure on profit margins going forward.

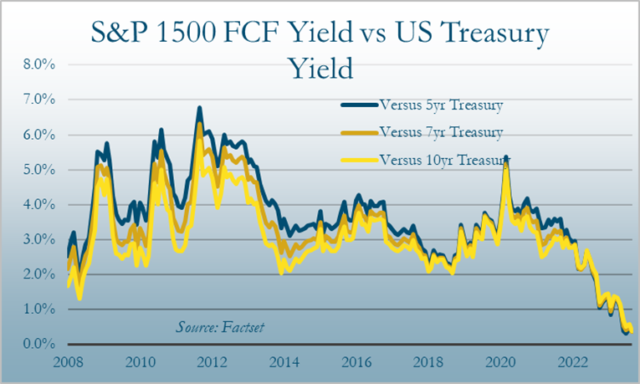

Which is important because equity valuations are still elevated. Last quarter we showed, using an inflation-adjusted Free Cash Flow metric, equities were more expensive than their 5-year and 15-year average levels. The third quarter’s sell-off brought valuations back to their five-year average using that metric, but when compared to U.S. Treasury Yields, U.S. Equities are more expensive than any time in the last 15 years. The same can be said for U.S. equities when compared to investment grade corporate bond yields. In other words, while equities may not appear as expensive in absolute terms as they were earlier this year, when compared to other investment options, equities still appear to offer an unfavorably skewed risk / reward profile.

Which is important because equity valuations are still elevated. Last quarter we showed, using an inflation-adjusted Free Cash Flow metric, equities were more expensive than their 5-year and 15-year average levels. The third quarter’s sell-off brought valuations back to their five-year average using that metric, but when compared to U.S. Treasury Yields, U.S. Equities are more expensive than any time in the last 15 years. The same can be said for U.S. equities when compared to investment grade corporate bond yields. In other words, while equities may not appear as expensive in absolute terms as they were earlier this year, when compared to other investment options, equities still appear to offer an unfavorably skewed risk / reward profile.

Fixed Income

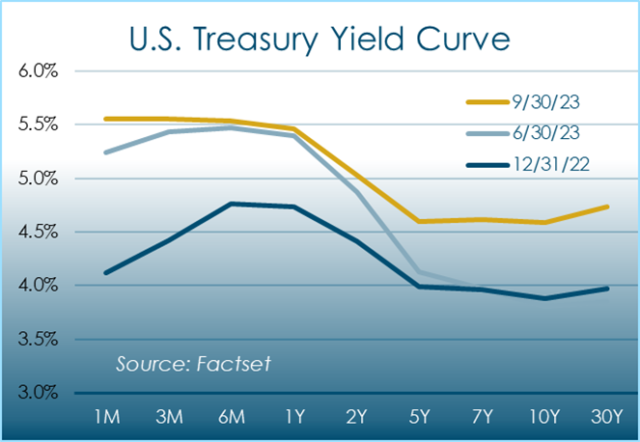

Stubbornly elevated inflation, a resilient labor market, and the rising possibility of avoiding a recession entirely all conspired to drive yields on U.S. Treasuries with maturities beyond five years significantly higher. Although it may be tough to see in the chart, the yield curve is materially less inverted now versus three months ago, an indication that investors either expect higher inflation for longer, better economic performance on an inflation-adjusted basis, or a combination of both. In this case, because inflation expectations, as imputed by comparing the yield differential between a U.S. Treasury bond and a similar maturity Treasury Inflation-Protected Security (TIP), were flat during the quarter, we conclude that bond investors anticipate better inflation-adjusted economic performance going forward. Higher yields on U.S. Treasuries pushed yields on investment-grade corporate bonds higher as well, pushing corporate bond prices down and further into the red for the year.

Stubbornly elevated inflation, a resilient labor market, and the rising possibility of avoiding a recession entirely all conspired to drive yields on U.S. Treasuries with maturities beyond five years significantly higher. Although it may be tough to see in the chart, the yield curve is materially less inverted now versus three months ago, an indication that investors either expect higher inflation for longer, better economic performance on an inflation-adjusted basis, or a combination of both. In this case, because inflation expectations, as imputed by comparing the yield differential between a U.S. Treasury bond and a similar maturity Treasury Inflation-Protected Security (TIP), were flat during the quarter, we conclude that bond investors anticipate better inflation-adjusted economic performance going forward. Higher yields on U.S. Treasuries pushed yields on investment-grade corporate bonds higher as well, pushing corporate bond prices down and further into the red for the year.

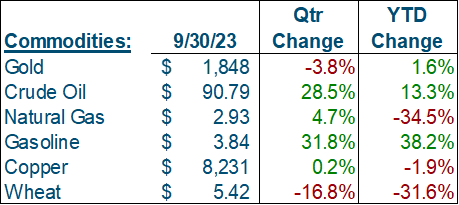

Commodities

Within the commodities complex, crude oil and gasoline were the standout performers. With Russian production volumes down, extended OPEC production cuts, and U.S., Iranian, and Brazilian production ramps offsetting only a portion of it, the global oil market is currently in a supply deficit and inventories, once above historical averages, are now below historical averages and falling. The knock-on effect for plastics and gasoline prices is an unwelcome factor that could indirectly push inflation higher if companies pass higher plastics and transportation costs along to their customers. The Federal Reserve will watch oil and gasoline prices carefully, for their influence on both inflation and consumer spending, which are vulnerable to extended periods of elevated gasoline prices.

Within the commodities complex, crude oil and gasoline were the standout performers. With Russian production volumes down, extended OPEC production cuts, and U.S., Iranian, and Brazilian production ramps offsetting only a portion of it, the global oil market is currently in a supply deficit and inventories, once above historical averages, are now below historical averages and falling. The knock-on effect for plastics and gasoline prices is an unwelcome factor that could indirectly push inflation higher if companies pass higher plastics and transportation costs along to their customers. The Federal Reserve will watch oil and gasoline prices carefully, for their influence on both inflation and consumer spending, which are vulnerable to extended periods of elevated gasoline prices.

Conclusion

Like many investors at the beginning of the year, we expected a global recession to begin at some point during the second half of this year. Although we believe Europe could slip into recession during the fourth quarter, the onset of a global recession prior to the end of the year appears unlikely. As the U.S. economy adjusts to higher rates, if the labor market can maintain its strength, the plausibility of avoiding a global recession altogether grows. We harbored a healthy dose of skepticism that the Federal Reserve could engineer a soft landing but must admit that the Fed may be getting it right.

With that said, our base case still involves a modest recession at some point next year. Underneath the surface of resilient economic activity, we see the initial signs of mounting stress, including fewer job openings as small and medium-sized businesses pull back on hiring plans, unemployment durations creeping higher as those let go have a slightly harder time finding re-employment, and consumer credit delinquencies rising, as noted above. Moreover, the Fed’s previous rate actions just recently started to exert downward pressure on the economy but will continue to exert increasingly forceful downward pressure on the economy through the end of the year into the first half of 2024.

Consumers, which have relied to a large extent on excess savings, built up after multiple rounds of stimulus receipts, have largely exhausted their excess savings and with the current savings rate materially below the historical average, must divert a larger portion of their disposable incomes to savings going forward. Higher interest rates on savings accounts will help, but higher gasoline prices will erode any benefit from higher interest rates. The resumption of student loan payments in October will add a modest, but important headwind to consumer spending.

As such, we still see the economic risks as tilted towards the downside. Our confidence in the timing of a potential recession is low, but believe that, based on the above factors and how they have historically played out over time, the economic environment this time next year could look markedly different than it does now.

With equity valuations elevated, and in our opinion, attractive alternatives in the bond market, where lower risk and higher yields tempt investors (especially baby boomers who, for the last 15 years, have had virtually no alternatives to an equity-heavy portfolio), as economic risks materialize, to shed equities in favor of bonds, locking in mid to upper single digit yields for many years out.

As such, we continue to be cautious about equities, much more constructive on bonds, but always looking for individual stocks whose long-term prospects are not fairly reflected in their stock prices. Although equity valuations may be elevated, we continue to search and find individual opportunities in the equity markets, especially among medium and small companies, where stock performance year to date hasn’t been as strong, valuations aren’t as elevated, and long-term prospects are relatively more attractive.