Sorry to interrupt the festivities Dave, but I think we’ve got a problem.

– HAL 9000 (2001: A Space Odyssey)

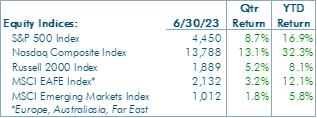

Global equity markets advanced during the second quarter, building on the first quarter’s strength.

Global equity markets advanced during the second quarter, building on the first quarter’s strength. Investors, clamoring to board the Artificial Intelligence hype train, crowded into a concentrated basket of technology and technology-related stocks, carrying equity indices into bull market territory (20% above the previous low).

Against the backdrop of A.I.-inspired enthusiasm, global economic data during the quarter was somewhat weaker than the first quarter, but there were bright spots, especially in the U.S. where persistent labor market strength and modest inflation improvements give us incrementally more optimism that inflation can reach the Federal Reserve’s 2% target without requiring a forceful or prolonged dislocation in economic activity. With that said, our baseline expectation still entails a modest recession towards the end of 2023 or first half of 2024.

Labor market strength notwithstanding, consumer spending slowed during the quarter, especially on goods, which has important implications for future employment in the manufacturing sector. Moreover, the combination of cumulative Federal Reserve rate increases and stricter bank lending standards will exert mounting pressure on broad economic activity but will specifically influence small business investment and hiring decisions, the key source of labor market strength.

All of which point to growing headwinds for economic activity, and likewise for equities, where valuations, after strong performance this year, are elevated. A.I. is a revolutionary technology and its economic and investment implications will be significant. However, its nascent stage and material challenges relegate widespread adoption to time frames that extend beyond this year and next. In the meantime, investors must grapple with mediocre economic performance that is likely to deteriorate as the year progresses. Stanley Kubrick and Arthur C. Clarke’s science fiction masterpiece, released 55 years ago, is just as prophetic today as it was 55 years ago. The question is whether investors will listen.

The Global Economy

Global economic activity during the second quarter resembled the steady, but uninspiring pace at which the first quarter concluded. Tight labor markets underpin the consumer, but consumer spending is flagging, especially on goods, and as such, the global manufacturing sector continues to contract. Inflation, while falling, is only doing so at a modest pace and remains uncomfortably above most central bank targets.

Global economic activity during the second quarter resembled the steady, but uninspiring pace at which the first quarter concluded. Tight labor markets underpin the consumer, but consumer spending is flagging, especially on goods, and as such, the global manufacturing sector continues to contract. Inflation, while falling, is only doing so at a modest pace and remains uncomfortably above most central bank targets.

In Asia, where consumer-oriented exports play an important role in economic activity, mediocre consumer spending, at home and abroad, is an unwelcome development for their economies, and for manufacturers and exporters in particular. On the flip side, import prices, which constitute a key element of inflation, continue to fall, allowing most Asian central banks to refrain from raising rates further. If economic activity weakens further and inflation progressively declines, Asian central banks may be the first to reduce rates to help stimulate economic activity.

In Europe, a tight labor market has failed to stimulate consumer demand enough to support the continent’s manufacturers, which, at this point, are clearly in recession. The services sector isn’t faring much better but has managed to avoid outright contraction so far. Broadly speaking, European economic activity is disappointingly dull. At the same time, stubbornly high inflation will force the European Central Bank to raise rates perhaps as many as three times this year, which will place additional downward pressure on economic activity. The combination of slow and deteriorating growth and additional monetary restrictions set the continent up for a likely recession before the end of the year.

In the U.S., economic activity was stable but unspectacular when compared to the first quarter. Labor market data continue to portray a wide imbalance between supply and demand, low unemployment, and a surprisingly strong pace of new hires given the small pool of available workers. Employment separations remain low and are primarily employee driven (quits versus layoffs). This strength is finally translating into positive inflation-adjusted wage gains and positive inflation-adjusted disposable income, which consumers are using to maintain spending levels, but not materially expand them.

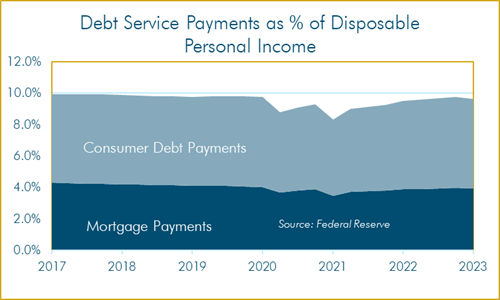

For example, retail sales during the quarter stagnated. Confronted with sharply higher borrowing rates for mortgages, car loans, and credit cards, debt payments have returned to pre-Covid levels after falling in 2020. At the same time, consumers appear to be focused on returning their savings rate, which plunged during Covid, back to historical levels. A greater portion of their paycheck going towards debt payments and a greater portion set aside as savings present a double headwind for consumer spending, especially for goods (as opposed to services).

For example, retail sales during the quarter stagnated. Confronted with sharply higher borrowing rates for mortgages, car loans, and credit cards, debt payments have returned to pre-Covid levels after falling in 2020. At the same time, consumers appear to be focused on returning their savings rate, which plunged during Covid, back to historical levels. A greater portion of their paycheck going towards debt payments and a greater portion set aside as savings present a double headwind for consumer spending, especially for goods (as opposed to services).

Although consumer spending is not growing, it remains strong enough to keep inflation, according to the Federal Reserve’s preferred inflation metrics (which exclude volatile food and energy prices, among other items) well above its target of 2%. In essence, inflation has cooled from a roiling boil to a high simmer settling in around 4.5% since December.

Inflation is a complicated mix of labor productivity, input cost pressures, and profit margins. Currently, all three are working against companies (wages and other input costs are up, labor productivity is down, and profit margins are down). As a result, companies are trying to, where they can, raise prices to mitigate some of the profit margin degradation. Prices are the main lever companies prefer to pull at the moment.

Which is where the Federal Reserve comes in. If it can weaken the labor market, bringing it back into balance, wage pressures may ease, opening the door for companies to relax price increases, which would help bring inflation down. Hence, the labor market is the Federal Reserve’s primary focus, and why, after skipping a rate increase in June, at least one, if not more, rate increases are likely before the end of the year.

Equities

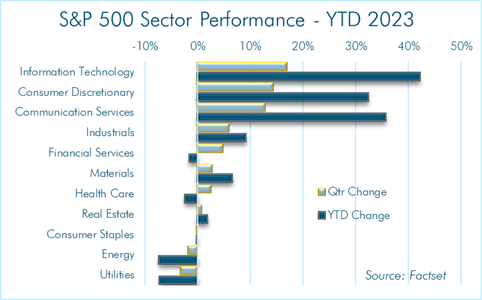

The second quarter of 2023 was the moment in which investors had their epiphany about the power and capability of Artificial Intelligence. Microsoft’s release of its A.I. infused search algorithm sparked a frenzy among investors who feared missing out on the next big thing, so they threw caution to the wind and snapped up technology stocks like Nvidia (up 52% for the quarter), Meta, the owner of Facebook and Instagram (up 35%), Amazon (up 26%), Microsoft (up 18%), Apple (up 17%) and Alphabet, the parent company of Google (up 15%). Nvidia, which supplies the bulk of chips used for A.I. training, is up 190% year to date. Nvidia is the new Taylor Swift.

The second quarter of 2023 was the moment in which investors had their epiphany about the power and capability of Artificial Intelligence. Microsoft’s release of its A.I. infused search algorithm sparked a frenzy among investors who feared missing out on the next big thing, so they threw caution to the wind and snapped up technology stocks like Nvidia (up 52% for the quarter), Meta, the owner of Facebook and Instagram (up 35%), Amazon (up 26%), Microsoft (up 18%), Apple (up 17%) and Alphabet, the parent company of Google (up 15%). Nvidia, which supplies the bulk of chips used for A.I. training, is up 190% year to date. Nvidia is the new Taylor Swift.

Captivated by A.I.’s promise, investors ignored earnings results, which came in below expectations and disappointing company guidance for the remainder of the year, which also came in below expectations. As we’ve been highlighting for a few quarters, we believed earnings estimates were too optimistic for this year and next, and at the risk of gloating, our belief is playing out. Investors now expect revenues for publicly traded companies to grow less than 2% this year and roughly 4% next year, which we think is plausible, but perhaps still too optimistic. More importantly, investors expect earnings this year to be flat compared to 2022, and then grow 12% in 2024, with Free Cash Flow growing 3.5% this year and nearly 20% next year. As you can imagine, we’re skeptical.

If investor expectations for this year and next materialize, using typical valuation methodologies such as Price / Earnings or Price / Book Value, equities don’t look all that expensive. We prefer to assess stock valuations using inflation-adjusted metrics, particularly inflation-adjusted Free Cash Flow, and Free Cash Flow compared to interest yields on corporate bonds. Using both of these metrics, stocks appear richly valued.

On an inflation-adjusted Free Cash Flow basis, stocks currently trade at a 60% premium to their 5-year average, and a 76% premium to their 10-year average. As inflation falls, all else equal, stocks’ inflation-adjusted Free Cash Flow will improve, which is what this chart depicts; the improvement in valuation starting in June 2022 is almost entirely the result of declining inflation, not lower stock prices or significantly higher Free Cash Flow.

On an inflation-adjusted Free Cash Flow basis, stocks currently trade at a 60% premium to their 5-year average, and a 76% premium to their 10-year average. As inflation falls, all else equal, stocks’ inflation-adjusted Free Cash Flow will improve, which is what this chart depicts; the improvement in valuation starting in June 2022 is almost entirely the result of declining inflation, not lower stock prices or significantly higher Free Cash Flow.

When we compare the Free Cash Flow yield on stocks to other asset classes, like investment grade non-financial corporate bonds, stocks also look expensive. Currently, an investor can pick up 1% per year in yield by owning an investment grade, non-financial corporate bond. Admittedly, stocks offer the opportunity for capital appreciation over time while bonds do not, but when compared to the last 15 years, stocks traditionally offered a 1% – 2% yield advantage, in addition to the capital appreciation potential. As we see it, the combination of optimistic earnings expectations and elevated valuations present a cautionary risk / reward profile, especially if our expectations for a modest recession prove correct.

When we compare the Free Cash Flow yield on stocks to other asset classes, like investment grade non-financial corporate bonds, stocks also look expensive. Currently, an investor can pick up 1% per year in yield by owning an investment grade, non-financial corporate bond. Admittedly, stocks offer the opportunity for capital appreciation over time while bonds do not, but when compared to the last 15 years, stocks traditionally offered a 1% – 2% yield advantage, in addition to the capital appreciation potential. As we see it, the combination of optimistic earnings expectations and elevated valuations present a cautionary risk / reward profile, especially if our expectations for a modest recession prove correct.

Fixed Income

Unlike stocks, which turned in positive performance for the quarter, rising interest rates meant price losses for bond investors across most maturities. Higher rates can be partially attributed to the Federal Reserve’s communicated intention to raise rates two more times this year, and partially attributed to the debt ceiling standoff in Congress, which created some uncertainty about whether the U.S. would honor its debt obligations.

Unlike stocks, which turned in positive performance for the quarter, rising interest rates meant price losses for bond investors across most maturities. Higher rates can be partially attributed to the Federal Reserve’s communicated intention to raise rates two more times this year, and partially attributed to the debt ceiling standoff in Congress, which created some uncertainty about whether the U.S. would honor its debt obligations.

In the corporate bond market, credit quality is still quite good. Companies capitalized on historically low bond rates to refinance their existing debt at lower rates with longer maturities. Hence, credit risks for most issuers is low and is likely to remain so even if a modest economic contraction occurs.

Commodities

With the exception of Natural Gas, commodities struggled during the quarter. Prior to quarter’s end, natural gas hit a multi-year low, which motivated gas-focused drillers to slow their pace of drilling and downsize the number of rigs drilling for gas to a 16-month low. Traders anticipate that lower production volumes will eventually result in lower inventories and a better balance between domestic supply and global demand.

With the exception of Natural Gas, commodities struggled during the quarter. Prior to quarter’s end, natural gas hit a multi-year low, which motivated gas-focused drillers to slow their pace of drilling and downsize the number of rigs drilling for gas to a 16-month low. Traders anticipate that lower production volumes will eventually result in lower inventories and a better balance between domestic supply and global demand.

Crude oil’s fall comes despite OPEC’s decision to cut output temporarily to shore up prices. Wheat, along with a number of other agricultural commodities continued to struggle, as healthy rains set the harvest season up for a bumper crop.

Conclusion

In 1968, when 2001: A Space Odyssey was released, mathematical theorists had already been working on the concept of autonomous computing machines for more than a decade. In essence, Artificial Intelligence is not new, and certainly not revolutionary. It is, however, evolutionary, and already plays an important role throughout society. The difference today is that A.I. is finally starting to show the promise of contextual understanding of language, and based on the contextual understanding of language, the ability to make free form decisions and demonstrate creativity. Whether A.I.’s free form decisions and creativity rival human decision-making and creativity is still highly debatable. Perhaps we’ll write a series of follow-up pieces on its implications for business, the economy, and investors.

In the meantime, we’re confronted with the current reality that economic activity is lackluster, and that multiple factors will increasingly exert downward pressure. For example, although the Federal Reserve raised rates forecfully last year, because inflation had risen so high, their efforts became restrictive only starting in the first quarter of 2023. Because monetary policy acts with a nine- to 18-month lag in most sectors, we have yet to experience the full impact of their actions, some of which they have yet to take.

Moreover, because monetary policy is a blunt tool, it is incapable of directly addressing the underlying catalysts for persistently high inflation, namely those factors that are driving services inflation at a pace the Federal Reserve finds unacceptable. As a result, the Federal Reserve’s actions will affect the economy broadly, but the individual inflation factors indirectly. Although we expect further progress on the inflation front, it will be slower than the Federal Reserve would like to see, and as such, will require the Federal Reserve to keep rates “higher for longer”, something it has been saying for some time.

As the effects of restrictive monetary policy are building, restrictive bank lending will also begin to exert downward pressure on economic activity. Banks had already tightened lending standards before the mini banking crisis of the first quarter, but the failure of four banks will serve to increase the degree of conservatism with which mid-sized and small banks operate for the next few quarters. No bank CEO wants to see their bank identified as the next vulnerable bank; it would be a scarlet letter that would undoubtedly trigger a deposit flight and jeopardize the viability of the bank. Although bank lending is less of a factor for large companies, which can turn to the publicly traded bond market, small and medium-sized firms rely to a large degree on bank lending for expansion and operations. Small and medium-sized firms are also the primary entities driving the labor market strength. When their primary source of funding gets harder and/or more expensive to obtain, their appetite for operational expansion and labor will recede.

On the consumer side, the Supreme Court’s decision to invalidate President Biden’s student loan forgiveness plan will bring back student loan interest payments, which, for many borrowers, will mean a monthly cash flow drain in the hundreds of dollars. This coincides with rising levels of financial stress, as evidenced by historically low, but rising credit card delinquency rates.

We expect these factors to build through the remainder of the year, steadily eroding the labor market’s strength, which is considerable. As such, we expect economic activity will remain positive during the third quarter and most likely into the fourth quarter, but that at some point late this year or early next, small and medium sized businesses will succumb to escalating financing stress, and with it, labor market strength will turn to labor market weakness. These two factors would occur coincidentally with consumer capitulation if it hadn’t already begun. With declining consumer spending, a weaker labor market, and small and medium-sized businesses in a defensive posture, it’s hard to see how economic activity overall can avoid a short, if shallow, period of contraction.

In the equity markets, such a scenario would likely produce slower sales growth and greater profit margin contraction than currently envisioned by investors. With valuations elevated, stock prices could be vulnerable. The valuation premiums to historical averages can adjust quickly with additional inflation declines, but as we’ve noted in the past, we’re skeptical that inflation will fall fast enough to rectify rich valuations.

Which brings us back to where we started, the underlying story of 2001: A Space Odyssey. Evolution. The science fiction marvel, which stands head and shoulders above the vast majority of science fiction tales, is a story about evolution: Mankind’s ability to learn, adapt and evolve. So, while we expect a modest recession and an equity market adjustment, ultimately it will set the stage for the next evolution of economic expansion and bull market advance, one that will be influenced by Artificial Intelligence. Let’s just hope that A.I. turns out to be benevolent, and not the evolutionary antagonist that most films depict it to be.