The economy has made considerable progress toward our dual-mandate objectives.

– Federal Reserve Chairman Jerome Powell

The first quarter of 2024 concluded with another solid gain for global equities, driven in part by ongoing U.S. equity market leadership. U.S. equities rose consistently throughout the quarter to record the best start to a year since 2019 and with the first quarter’s performance, have advanced in five of the last six quarters.

The first quarter of 2024 concluded with another solid gain for global equities, driven in part by ongoing U.S. equity market leadership. U.S. equities rose consistently throughout the quarter to record the best start to a year since 2019 and with the first quarter’s performance, have advanced in five of the last six quarters.

Economic activity in the U.S. increasingly points to a goldilocks scenario. Previous Federal Reserve rate actions appear to be moving the labor market into a better balance, moderating wage inflation without unduly disrupting its role as the foundation supporting consumer spending. Rebounding labor productivity allows businesses to raise wages without compromising profit margins, the critical element of investor earnings expectations for this year and next.

Against this backdrop, the Federal Reserve’s shift towards a bias to lower rates is logical, even if the timing of its initial rate reduction is debatable. The risk of a monetary policy error going forward is significantly lower today than 12 months ago, leaving investors with better visibility into the economic and corporate earnings outlook, justifying investor confidence.

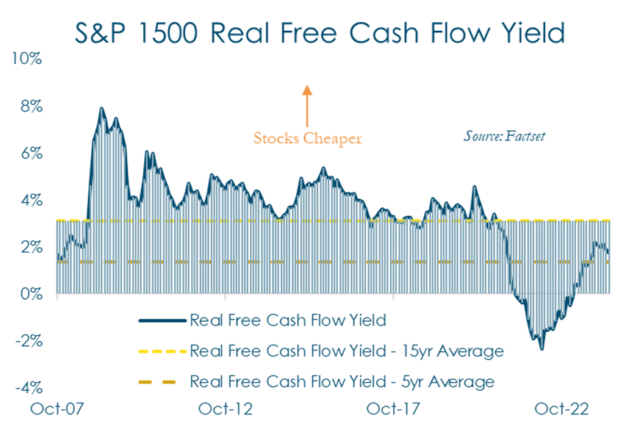

This confidence is reflected in somewhat elevated equity valuations, although in some respects, stocks are cheaper today than they have been, on average, over the last five years. More importantly however, is the fact that with such a strong performance during the first quarter, and equities’ string of wins over the last six quarters, the goldilocks scenario appears to be the baseline investor expectation. If so, stocks can perform well the remainder of the year, but returns will likely be lower on a quarterly basis unless additional positive earnings surprises materialize (not our base case). Hence, our expectation for positive, but lower equity market returns through the rest of the year.

The Global Economy

Economic activity stabilized during the first quarter, though for most countries, activity remains below their long-term potential rate of expansion. Nevertheless, a global recession appears less likely based on the first quarter’s data, a welcome outlook given central banks’ considerable monetary policy tightening efforts in 2022 and 2023.

Economic activity stabilized during the first quarter, though for most countries, activity remains below their long-term potential rate of expansion. Nevertheless, a global recession appears less likely based on the first quarter’s data, a welcome outlook given central banks’ considerable monetary policy tightening efforts in 2022 and 2023.

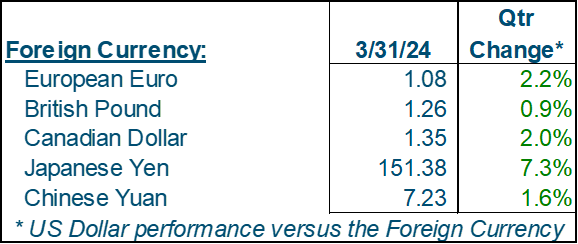

In fact, with the exception of Japan, where the ongoing weakness of the yen has pushed inflation higher and forced the Bank of Japan to end its negative interest rate policy, global inflation continues to moderate, allowing central banks to shift their policy bias towards lower rates, a modest but timely tailwind to economic activity later this year and into 2025.

In the U.S., the economic data portray an economy that is settling into a modest but healthy pace of expansion (1.5% in the first quarter versus 3.4% in the fourth quarter of 2023), underpinned by an improving balance between supply and demand in the labor market, which in turn helps to cool wage-related cost pressures. Though companies curtailed hiring efforts, demand for labor still exceeds supply, and as such, companies continue to compensate their employees well, raising wages faster than inflation, which they can do without compromising profit margins because productivity is also quite healthy. In other words, although labor still has the negotiating advantage, higher productivity means companies are getting more value for what they are paying for.

This virtuous interaction between labor market strength, healthy wage gains and positive productivity supports ongoing consumer spending strength, which also benefits from the fact that, with interest rates on their savings in the mid-single digits, consumers can save less and spend more because their savings are earning higher rates of return. Strong consumer spending feeds back into healthy economic activity, which further reinforces business’ need for labor.

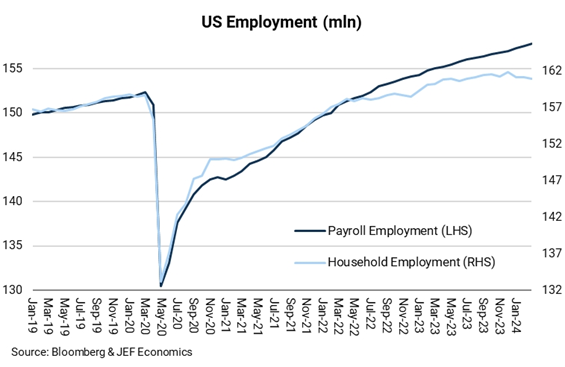

That’s not to say the risks to the goldilocks outlook are negligible. For example, the U.S. publishes two labor market reports, one that draws from households (the household survey) and one that draws from businesses (the establishment survey). Although the surveys may diverge slightly over the course of a few months, over multiple quarters and years, the two tend to paint a similar picture of the labor market.

However, since May 2022, the household survey’s results have diverged from the establishment survey, failing to confirm the apparent strength within the establishment survey (which is used for the headline payroll data reported in the media). Perhaps the labor market is not quite as strong as it appears on the surface, which would explain why voluntary separations (quits) are trending down, even though a variety of employee satisfaction surveys indicate employees are highly dissatisfied with their employers and are considering the pursuit of other opportunities. Small business owners are just as unhappy; citing the lack of labor quality, inflation, and now higher borrowing rates and tighter bank lending standards, fewer small business owners expect to make capital outlays, and even fewer expect to hire more employees.

However, since May 2022, the household survey’s results have diverged from the establishment survey, failing to confirm the apparent strength within the establishment survey (which is used for the headline payroll data reported in the media). Perhaps the labor market is not quite as strong as it appears on the surface, which would explain why voluntary separations (quits) are trending down, even though a variety of employee satisfaction surveys indicate employees are highly dissatisfied with their employers and are considering the pursuit of other opportunities. Small business owners are just as unhappy; citing the lack of labor quality, inflation, and now higher borrowing rates and tighter bank lending standards, fewer small business owners expect to make capital outlays, and even fewer expect to hire more employees.

Inflation’s cooling trend is welcome by the Federal Reserve, which would like to bring its policy rate down to alleviate some of the small business stress and avoid a recession. Based on comments from various Federal Reserve governors, they are actively discussing the timing of their first 0.25% rate reduction, and are guiding investors to expect it mid-year, with another two 0.25% reductions before the end of the year. Inflation will likely need to fall further for that scenario to materialize, but we think it’s a reasonable expectation at this point.

Equities

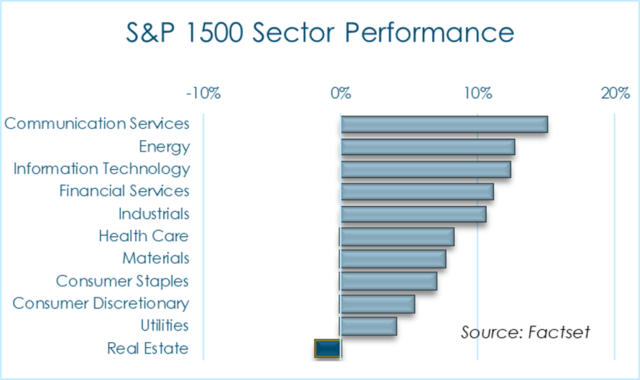

The favorable economic data and the Fed’s imminent rate reduction played into investor confidence for corporate profits, pushing every sector other than Real Estate, which trades more like fixed income, higher. Investors continue to favor large artificial intelligence-related stocks, including Nvidia, which gained another 82% during the quarter, and Meta (Facebook), which rose 37%.

The favorable economic data and the Fed’s imminent rate reduction played into investor confidence for corporate profits, pushing every sector other than Real Estate, which trades more like fixed income, higher. Investors continue to favor large artificial intelligence-related stocks, including Nvidia, which gained another 82% during the quarter, and Meta (Facebook), which rose 37%.

Some investors may look at the stratospheric performance of technology stocks and define the current run as a bubble, but doing so would ignore the sizable upward earnings revisions within the sector, in part attributed to artificial intelligence, but more so attributable to an ongoing expansion of digital workflows, and the hardware, software, networking and infrastructure required to support it. Artificial intelligence is but one technological advancement supporting the strong outlook for information technology companies.

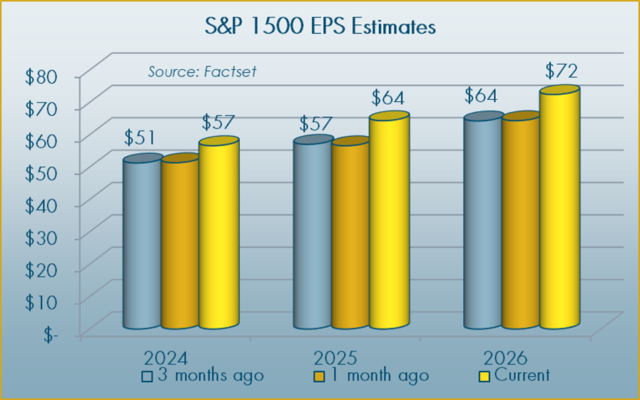

Moreover, upward earnings revisions for technology stocks is just one element of a broad upward revision trend across the equity market. To wit, earnings estimates for this year and next have risen 12% in the last three months. As a result, though equities posted strong, double-digit gains during the quarter, as earnings estimates keep pace, equity valuations were relatively stable during the quarter; stocks now trade at a Price / Earnings multiple of 20x versus 19x at the beginning of the year.

Moreover, upward earnings revisions for technology stocks is just one element of a broad upward revision trend across the equity market. To wit, earnings estimates for this year and next have risen 12% in the last three months. As a result, though equities posted strong, double-digit gains during the quarter, as earnings estimates keep pace, equity valuations were relatively stable during the quarter; stocks now trade at a Price / Earnings multiple of 20x versus 19x at the beginning of the year.

Using our preferred valuation metric, inflation-adjusted free cash flow yield, equities appear more expensive on average than they have over the last 15 years, but cheaper than they have over the last five years. It’s not a compelling argument to buy stocks right now, but neither is it a conclusive assumption that the first quarter’s performance will limit further strength over the remainder of the year.

Fixed Income

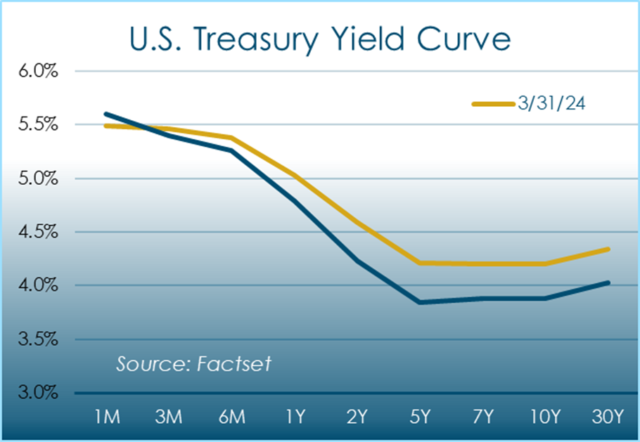

For fixed income investors, improving economic data was a headwind, as medium- and long-term rates rose, pushing bond prices down. The yield curve’s inversion can be an indication that an economic recession is likely, but in this case, because there are so many crosscurrents and extraordinary factors at play in the U.S. Treasury market, we tend to believe the direction, rather than the actual shape, of the yield curve is more indicative of the future direction of the U.S. economy. We also point to narrowing corporate bond spreads versus U.S. Treasuries, an indication that investors are less concerned about corporate fundamentals over the next few years.

For fixed income investors, improving economic data was a headwind, as medium- and long-term rates rose, pushing bond prices down. The yield curve’s inversion can be an indication that an economic recession is likely, but in this case, because there are so many crosscurrents and extraordinary factors at play in the U.S. Treasury market, we tend to believe the direction, rather than the actual shape, of the yield curve is more indicative of the future direction of the U.S. economy. We also point to narrowing corporate bond spreads versus U.S. Treasuries, an indication that investors are less concerned about corporate fundamentals over the next few years.

Commodities

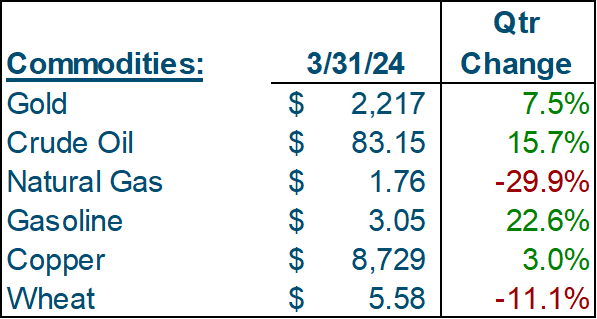

Within the commodity complex, oil, gasoline and gold rose. Oil is the beneficiary of an improving global economic outlook which supports demand, while at the same time, OPEC and other producers continue to restrain global supplies in an effort to support prices. Gold hit an all-time high during the quarter, somewhat unexpectedly with the U.S. dollar rising and yields on medium- and long-term U.S. Treasuries also higher.

Within the commodity complex, oil, gasoline and gold rose. Oil is the beneficiary of an improving global economic outlook which supports demand, while at the same time, OPEC and other producers continue to restrain global supplies in an effort to support prices. Gold hit an all-time high during the quarter, somewhat unexpectedly with the U.S. dollar rising and yields on medium- and long-term U.S. Treasuries also higher.

Conclusion

The Federal Reserve’s charter mandates that it promote two compatible, but potentially contradictory objectives; maximum employment and stable prices. We, along with many other investors, were skeptical that the Fed could accomplish the latter without sacrificing the former. But as the economic data demonstrate, the economy has made considerable progress toward the accomplishment of their dual mandate, and a goldilocks scenario has become more visible.

The combination of a strong labor market, positive productivity, modest inflation, reasonable interest rates on savings accounts, and a healthy consumer balance sheet produce a powerful self-supporting feedback mechanism that can sustain inflation-adjusted economic growth in the 2% range, which, given U.S. demographics, is about the upper limit the economy can be expected to grow over the long-term. Such a scenario would also be a goldilocks scenario for investors.

With mid-single digit returns on the fixed income portion of their portfolio, bonds now make a meaningful contribution to a portfolio’s total rate of return, something they couldn’t do for most of the last 15 plus years. On the equity side, average valuations and steadily expanding business fundamentals could produce equity returns in the upper single digits, a somewhat more optimistic outlook when compared to our view at the end of 2023. Taking them both together, investors can more confidently hope for upper single digit returns for the next few years if economic activity unfolds as expected, which may not sound exciting, but it would be sustainable and effective.